- Elkem

- Sustainability

- Climate strategy

Climate strategy

Elkem’s strategy is to develop more sustainable production processes and lowering of the group’s carbon footprint through use of renewable sources, energy recovery and reduction of waste. In addition, Elkem’s strategy is to develop specialised products and services that can be key enablers in the green transition, such as electrification of transportation, reduced energy consumption, increased production and availability of renewable energy, increased energy storage and replacement of oil-based materials.

In October 2021 Elkem announced an updated climate roadmap. More information here.

Adaption to climate change and transition to more sustainable solutions will impact our business and financial conditions going forward. To mitigate these risks, Elkem is committed to ambitious targets and continuous improvements, reducing the emission to net zero by 2050.

Ambitions and targets

Elkem’s ambition is to reduce both the absolute emissions of the company and the product footprint, by increasing the use of renewable carbon sources and development of innovative production processes. The company endorses the intention of the Paris agreement of limiting global warming to well below 2 degrees.

Targets:

- Reduce our absolute emissions in scope 1 (direct) and scope 2 (indirect) with 28% by 2031.

- Reduce the product carbon footprint by 39% by 2031.

- Long term goal is to be net zero by 2050.

- Grow our market share in the green transition towards 2030

- Enable more circular economies.

Elkem’s direct and indirect emissions (scope 1 and 2) today amount to 3.3 million tonnes (mt) of fossil CO₂ equivalents, which will be reduced by 28% to 2.4 mt by 2031. The majority of Elkem’s direct emissions come from its smelters in Europe, particularly in Norway and Iceland. The majority of the company’s indirect emissions come from China and the use of fossil fuels in the electricity mix.

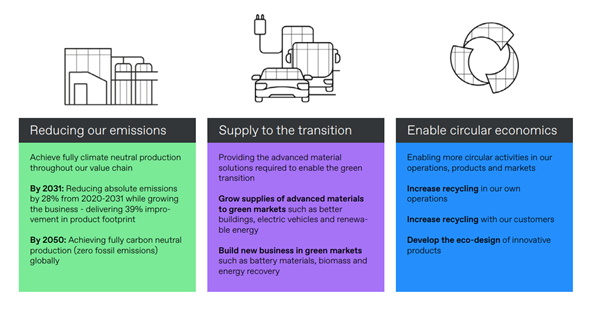

Elkem has a number of ongoing activities to reduce its CO₂ footprint. These activities are mainly grouped in three main areas:

The emissions from our six Norwegian plants accounts for just over 50% of the total direct CO₂ emissions in the company, and it mainly originates from our smelting furnaces. Our target is that minimum 40 % of the direct CO₂ emissions from the Norwegian smelters will come from renewable and thus CO₂ neutral sources by 2030. Renewable reduction agents based on biocarbon is part of the natural carbon cycle. Increased use of biocarbon in Norway, will therefore have substantial effect on lowering the group’s total fossil CO₂ emissions as well as further fostering technology development on biocarbon.

Biocarbon must be used in a sustainable manner, financially and environmentally and social. The Elkem Paraguay plant, which has been constructed from the ground up for utilisation of biocarbon, has already demonstrated that the production process can utilise 100% biocarbon.

In order to replace fossil coal with renewable biogenic sources, such as charcoal and woodchips, the renewable sources must be produced in a sustainable and resource efficient way. Elkem has developed a new resource efficient, breakthrough technology for production of biocarbon and will build a pilot plant in Canada. We will ensure the use of best available technology and that the production is environmentally and socially certified as well as economically sustainable. In addition, we continue to improve our reporting on emissions throughout the value chain and identifying and implementing measures to support our reduction target. Elkem’s goal is to achieve carbon neutral metal production by 2050.

Governance and responsibilities

The board of Elkem has the ultimate responsibility for climate-related issues, which is an integrated part of the business strategy. The board is actively engaged in Elkem’s climate strategy, target setting and measures for reducing the group’s CO₂ footprint. The board follows up and reviews the climate strategy on an annual basis as part of the group’s strategy process. The climate risk assessment is based on possible changes in regulations, customer preference, production technology, physical and market regulations.

The highest management level position of responsibility for climate-relates issues is the CFO. The CFO is responsible for managing the ESG Steering Committee. This is the corporate body with responsibility for climate-related issues and consists of members of the corporate management. The ESG steering committee reports to the CEO, who is the formal owner of Elkem's policy and procedures for climate-related topics.

Strategy and risk management

Elkem has proactively identified the risks and the opportunities related to climate change that have the greatest impact on our business. Climate-related issues represent important risk factors to the business, as well as attractive business opportunities since our products can be key enablers for lower GHG emissions through renewable energy, energy storage, electrification of transportation, etc. Climate issues are therefore an integrated part of Elkem’s business strategy. Elkem aims to limit the long-term global temperature increase to well-below 2°C, in line with the Paris agreement. To achieve this target, Elkem will apply the climate roadmap that details this commitment.

The mission is to provide advanced material solutions shaping a better and more sustainable future. Elkem has a clear corporate strategy to strengthen our competitive positions through specialisation and growth. To deliver on the roadmap, Elkem will focus on three key levers: Reducing the fossil CO₂ emissions, supplying to the green transition, and enabling more circular economies.

For more information about our strategy work and scenario analysis, please see the TCFD report.

In 2021 Elkem started implementing the recommendations in the TCFD climate risk framework, and launched the first report according to the TCFD disclosure recommendations.

Elkem’s process of identifying, assessing, and managing climate-related risks and opportunities (R&O’s) is integrated into our multi-disciplinary company-wide risk management process. The climate-risk process is integrated into a multi-disciplinary company-wide risk management process. The process used to determine whether any of our risks in the value chain, including direct operations, upstream and downstream, could potentially have a substantial financial impact is based on quantifiable factors that will affect Elkem’s EBITDA, cash flow and equity. When it comes to climate-related risks, the risk management processes are however, not only limited to the substantive risks. Elkem also include possible climate risks with lower thresholds. Risks that today are perceived to have limited financial impact or frequency could increase going forward as a result of climate change. Such risks particularly include acute and chronic physical risks.

Physical risks

Elkem’s processes and plants are not deemed to be exposed to acute physical risks. Neither the location of the plants, nor the production processes are sensitive to acute flooding, drought, heat stress or wind.

Water is important as input to silicones production and for power supply to the company’s smelters as well as for cooling purposes. Possible climate impact is therefore assessed as a part of our strategic planning processes.

As the progression of climate change continuous, acute risks might be more relevant for us in the future. Elkem’s physical assets or infrastructure assets could be destroyed or disrupted, leading to loss of functionality, decline in the services they provide or a rise in the cost of these services.

Transitional risk

The transitional climate risks are mainly defined as strategy and operational risks. The strategic risks are mainly related to factors potentially impacting Elkem’s operations, available technology for reducing emissions, changes in regulations from authorities and changes in consumer preferences. Our direct operational risks are related to risks of major emissions or other incidents with negative impact on the environment which is integrated into a multi-disciplinary company-wide risk management process.

Some examples of transitional risks for Elkem:

Regulatory risks: The European Green Deal and Taxonomy, framework for sustainable raw materials, regional and national emission requirements, carbon pricing, environmental requirements in procurement, border fees and escalated trade wars.

Technical risks: Replace fossil coal with renewable biobased sources, waste and water management, digitalisation, positioning within strategic segments such as battery production, electrification of shipping and long-distance transport, circular economy efforts, new leap frogging technology.

Market risks: Restricted access to raw materials (biobased sources), affordable renewable energy, customer/consumer demand on lower CO₂ footprint and life cycle analysis, increased demand of recycled materials, waste management, adapt business model to new growth markets/segments.

Reputational risks: Transparency and disclosure on ESG issues, environmental conscious consumers demand lower footprint, process industry is seen/not seen as part of the green shift /future businesses.

Three of the key drivers for reducing future CO₂ emissions in Elkem's value chain are an increased availability of biocarbon, increased demand for green products (especially batteries), and the cost of CO2 emissions.

The table below shows a simple consequence evaluation of the threats and opportunities identified. For a more comprehensive risk and opportunity analysis, please see the TCFD report.

|

EXPOSURE: |

VULNERABILITY: |

CONSEQUENCE: |

|

CARBON PRICE |

Uncertainty around quota pricing, distribution of free quotas and compensation systems, primarily in Europe. However, this must be balanced against risk of carbon leakage in the global market. |

High costs with high CO2 prices, if production is not changed. Having a strategy for phasing in biocoal reduces the risk for high carbon prices. |

|

USE OF BIOBASED SOURCES |

Lack of predictable access in Norway. |

Opportunity for emission-free, and possibly carbon-negative production improves competitiveness. |

|

DEMAND FOR GREEN PRODUCTS |

Production of renewable energy. |

Good market position. Changing demand, needs and preferance from customers. |

Model inspired by Report 06/2018 How will we confront climate risk? By the Norwegian climate foundation (Norsk klimastiftelse) (p. 27.)

Contact us

Take your business to the next level by partnering with a world-leading material manufacturer.